What is PAN number?

Permanent Account Number is an unique identification number and is in alpha numeric combination which was introduced by the income tax in 1961. It is issued under the supervision of the central board of direct taxes and which is capable to serve as an Identification proof. This number is very important to transfer your money in the banks and also at the time of opening and all related to taxes.

The main reason behind the introduction of PAN number is to bring the identification key factor for all the financial transactions and also to prevent the tax. It is a unique id for both the national and permanent. The structure of the PAN number is as follows and the purpose and the details for that unique ID is explained below.

How the PAN number is Designed?

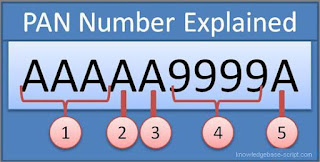

PAN number will be a 10 digit number and will be like XXXXX0000X. The first 5 places is occupied by the alphabets and then the 4 places will be filled with numbers and the last number will be filled with the alphabet.

The meaning of all the places is given below. The first three characters are taken from AAA to ZZZ randomly and the fourth place is occupied by any of the below digits depending on the status of the pan holder.

- C-company

- P-person

- H-HUF hindu undivided family

- F-firm

- A-association persons

- T-association persons trust

- B-body of individuals

- L-Local authority

- J-artificial juridical person

- G-government

The 5th place represents first character of the pan card holder like surname/last name.Next four characters are the numbers starting randomly from 0001 to 9999. Last place is an pan alphabetic check digit.

PAN Card can be apply Online and also check their Status here- http://www.incometaxindia.gov.in/home.asp#